Navigating the Economic Rollercoaster: An Austrian School Perspective on Investment

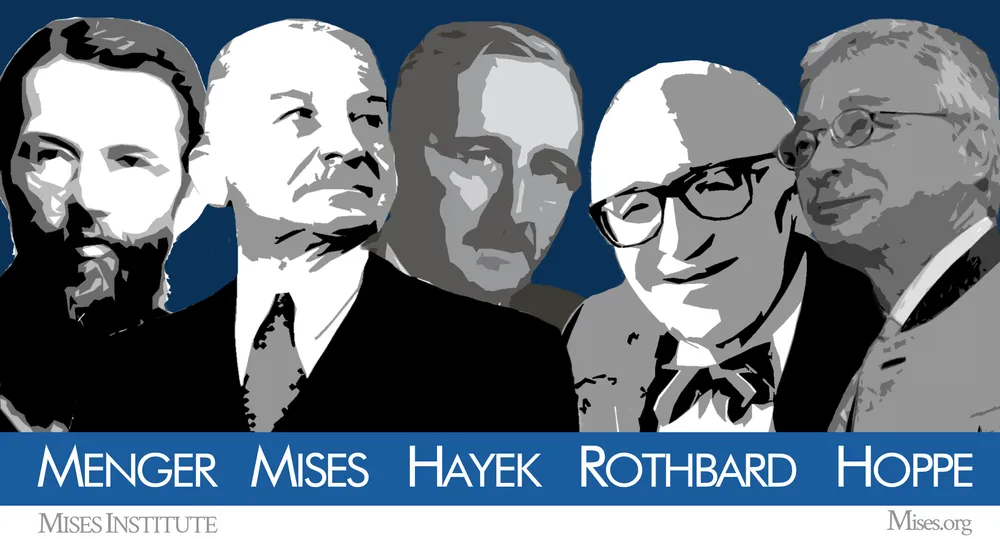

The Austrian School of economics offers a unique perspective on the cyclical nature of boom and bust periods. Unlike Keynesian economists who advocate for government intervention, Austrian economists believe that these cycles are driven by artificial manipulation of interest rates and credit markets, often by central banks. When interest rates are artificially lowered, it creates a false signal of abundant savings, leading to malinvestment (investment in projects that are not truly profitable in a free market) and an unsustainable boom.

The Austrian School of economics offers a unique perspective on the cyclical nature of boom and bust periods. Unlike Keynesian economists who advocate for government intervention, Austrian economists believe that these cycles are driven by artificial manipulation of interest rates and credit markets, often by central banks. When interest rates are artificially lowered, it creates a false signal of abundant savings, leading to malinvestment (investment in projects that are not truly profitable in a free market) and an unsustainable boom.

This perspective emphasizes understanding the natural forces of supply and demand in a free market. It suggests that investors should be wary of excessive government intervention and focus on assets that hold intrinsic value during periods of economic uncertainty.

Here’s how an investor adopting the Austrian School viewpoint might approach investing during different phases of the boom-bust cycle:

Early Boom:

- Exercise caution, as artificial booms often begin with government intervention.

- Consider deep value stocks - companies with low debt, strong cash flows, and businesses less susceptible to market distortions.

- Be wary of excessive debt and leverage.

Peak Boom:

- Reduce exposure to assets inflated by artificial credit expansion.

- Favor investments with intrinsic value like commodities, particularly gold and silver, which often act as a store of value and a hedge against inflation.

- Increase cash reserves to prepare for potential market corrections.

Transition to Bust:

- Maintain high cash reserves to capitalize on buying opportunities that will emerge.

- Focus on capital preservation as market volatility increases.

- Consider short-term bonds or fixed-income securities for stability.

Bottom of Bust:

- Look for undervalued assets and businesses with strong fundamentals. This is the time when assets artificially inflated during the boom can be purchased at a discount.

- Gradually increase exposure to equities as the market begins to recover.

- Remain cautious of high debt levels and leverage.

Recovery and Transition to Boom:

- Increase investments in productive assets and businesses poised for growth.

- Monitor for signs of renewed artificial credit expansion – are interest rates being manipulated again?

- Maintain a diversified portfolio aligned with long-term investment goals.

The Difficulty of Timing the Market

It is important to remember that identifying the exact turning points in an economic cycle is extremely difficult. The guidelines above are meant to be a general framework, not a precise roadmap.

Real Estate in the Austrian Framework

Real estate, due to its sensitivity to interest rates, is an asset class often discussed within the Austrian School. During artificial booms, real estate can become significantly inflated. As such, caution is warranted during these times. Conversely, the bust phase can present buying opportunities, provided one understands the local market dynamics and avoids excessive debt.

Investment Strategies Summary Table

| Economic Phase | Investment Strategies |

|---|---|

| Early Boom | * Exercise caution with investments in assets inflated by artificial booms. * Consider deep value stocks. * Avoid excessive debt. |

| Peak Boom | * Reduce exposure to inflated assets. * Favor commodities, especially gold and silver. * Increase cash reserves. |

| Transition to Bust | * Maintain high cash reserves. * Focus on capital preservation. * Consider short-term bonds. |

| Bottom of Bust | * Look for undervalued assets. * Gradually increase equity exposure. * Remain cautious of high debt levels. |

| Recovery and Transition to Boom | * Invest in productive assets. * Monitor for artificial credit expansion. * Maintain a diversified portfolio. |

Disclaimer: This content is for informational purposes only and not financial advice. Consult a financial advisor before making investment decisions. The Austrian School’s perspective is one of many economic viewpoints, and its predictive power, like all economic theories, is subject to debate.